devcon 5 / a review of short term interest rates of tokens in the ethereum defi space why they exist and how to interact with those smart contracts

- YouTube

- IPFS

- Details

A review of short term interest rates of tokens in the Ethereum Defi space, why they exist and how to interact with those smart contracts

Duration: 00:06:03

Speaker: Akash Patel

Type: Breakout

Expertise: beginner

Event: Devcon

Date: Invalid Date

This a review of the current interest rate economics in the Ethereum space. A quick look at loanscan.io will show tons of projects interacting with each other to create lending and borrowing opportunities. We are here to review why they exist and show on a practical level how to interact with these smart contracts. Most use cases will be earning a high-interest rate or getting a loan of a cryptocurrency.How do you make sure your money is safe, what risks are you taking, how is this different than lending/borrowing money in the "real" world? We will go through a practical example of taking USD and entering the crypto world, interacting with a smart contract and earning interest. The hope is to teach anyone to do this in 10 minutes.

Categories

- Related

Devcon

Talk

17:05

Nano-payments on Ethereum

Piotr Janiu of Golem (http://golemproject.net/) presents on Nano-payments on the Ethereum blockchain

Devcon

Talk

30:33

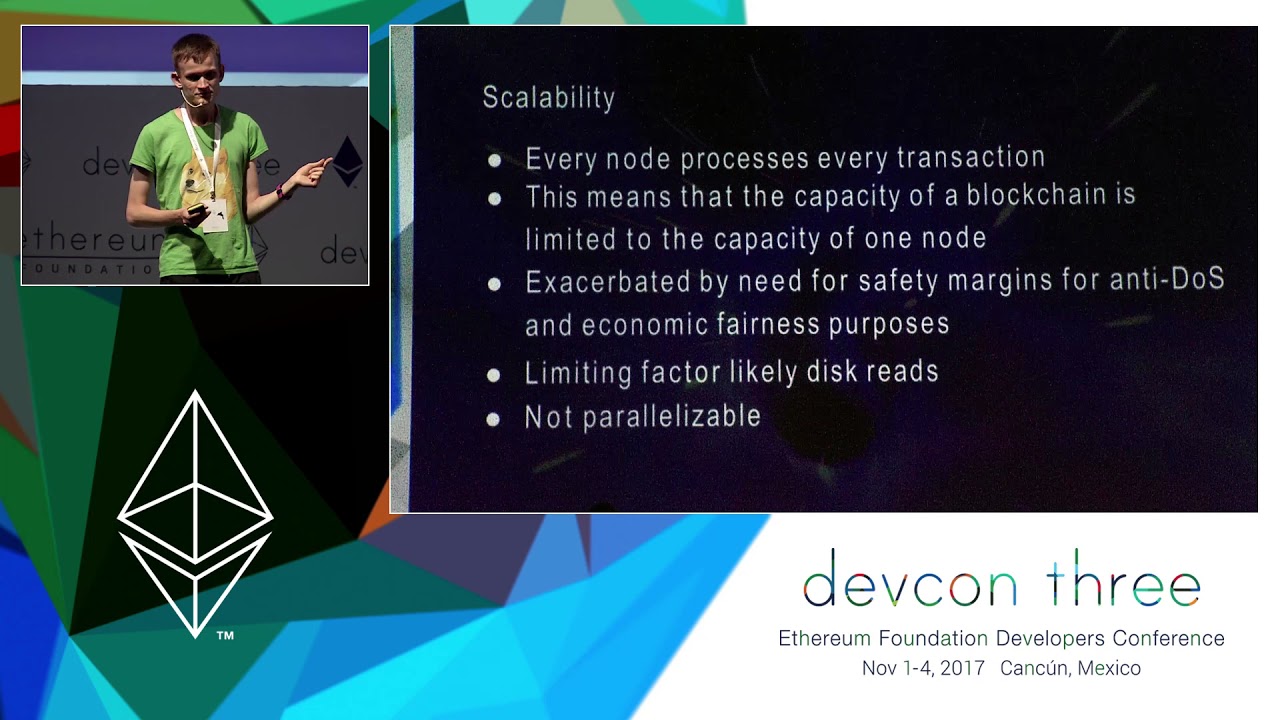

A Modest Proposal for Ethereum 2.0

Vitalik Buterin gives his talk titled, "A Modest Proposal for Ethereum 2.0"

Devcon

Talk

09:40

Liquidity on Blockchains

Casey Detrio presents on Liquidity on Blockchains with Batch Auctions and Smart Markets.

Devcon

Talk

13:41

Synthetic Assets

Dominic Williams presents on Synthetic Assets at Ethereum's DEVCON1.

Devcon

Talk

20:54

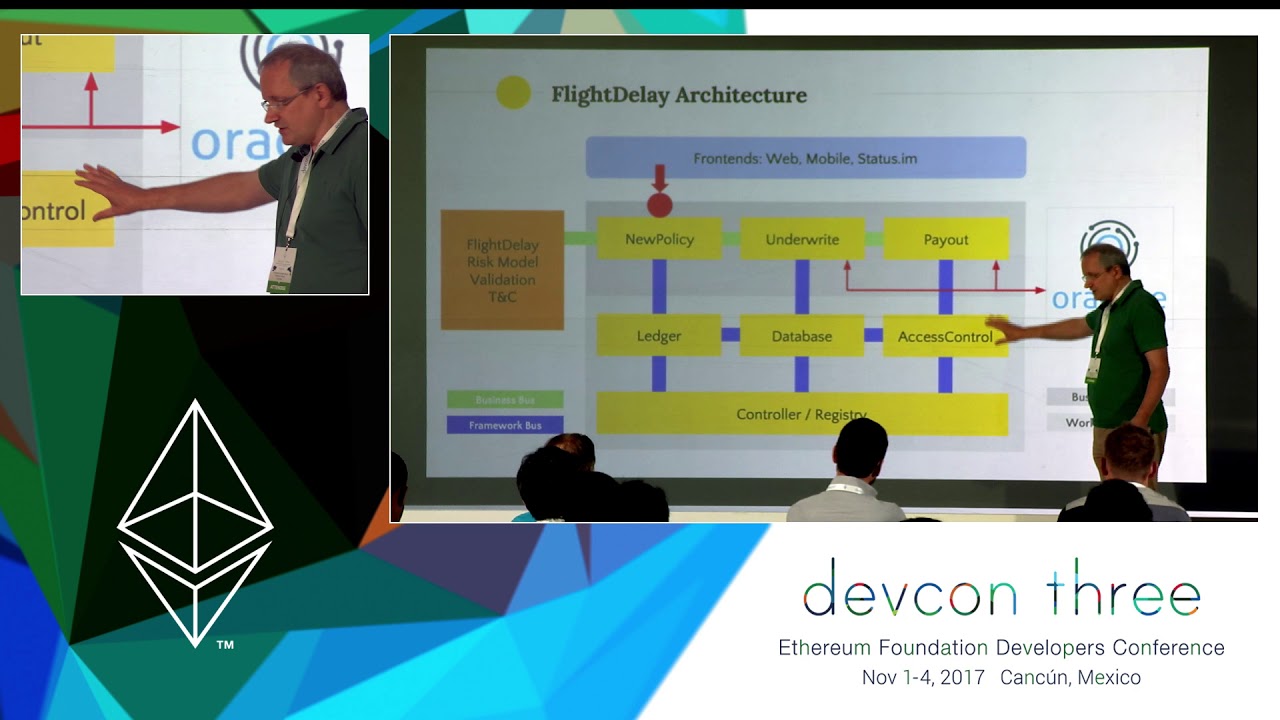

A Standardized Business Model for Decentralized Insurance

We at Etherisc are building the first decentralized insurance on the blockchain. Decentralized means that we are not building a company only, but a standardized protocol and a platform on which many participants can build insurance products and trade risks.

Devcon

Talk

19:18

Dai Stablecoin

The process of developing the Dai Stablecoin System has matured significantly over the course of the last year. We innovated in the Ethereum community by being the first project to release a well-defined reference implementation, written in Haskell, for our proposed system. This effort has helped with the simplification of the system’s design, increased project efficiency, and has attracted the attention of formal verificiation specialists who now want to focus on Maker. It is becoming more and more likely that Maker will be the first non-trivial decentralized application to be formally verified before launch. In this proposed presentation, I would like to talk about the usefulness of rigorous specification and external reference implementations for the benefit of other Ethereum projects.

Devcon

Talk

21:39

Programmable Incentives: Intro to Cryptoeconomics

Karl Floersch presents their talk titled, "Programmable Incentives: Intro to Cryptoeconomics"

Devcon

Breakout

21:16

Economics of Ethereum 2.0

This will be a presentation reviewing the Ethereum 2.0 Economics for an average validator. The talk will highlight the validator economics based on the current spec that can be expected for Phase 0 and Ethereum 2.0 at a mature state. The presentation will result in a call for community feedback on the proposed economics, which will be done through a public facing Ethereum 2.0 calculator built by the EF and ConsenSys.

Devcon

Lightning Talk

07:05

Shouldn’t we rethink debt? What DeFi can learn from susu’s and immigrant lending clubs

With hundreds of millions collateralized in products like Compound Finance and Maker, the Ethereum community is rightfully rallying around #DeFi. Yet, one could easily draw portentous parallels to the systemic risks of financial innovations in the early 2000s: credit default swaps, hybrid securities, and so on. In this lightning talk I will implore our community to look toward another concept of lending used around the world: the susu. The susu (tanda in Latin America, hui in Asia, or a “rotating savings and credit association: ROSCA), is a type of short-term no-interest loan among members of a small community. Each person in the susu makes the same contribution to the pool of money, and on a rotating basis, one person receives the total amount added to the pool. I first encountered this concept when visiting my partner’s family in Trinidad and Tobago, and am studying how communities in NYC rely on these informal lending clubs to pay for a flight, a home down-payment, or just for fun. If Ethereum will bring greater financial access, we should focus less on imitating the sophisticated financial products of Wall Street and instead look to the ways that communities without financial access already get by.

Devcon

Breakout

04:05

Shaky ERC20 Allowances

Sometimes, we can't see the forest for the trees. When not used carefully in dapps, ERC20 token allowances fit that description perfectly. This presentation goes into the story of how I accidentally put over 10,000 DAI at risk for my users, even if they only deposited 100 DAI in the smart contract per se.